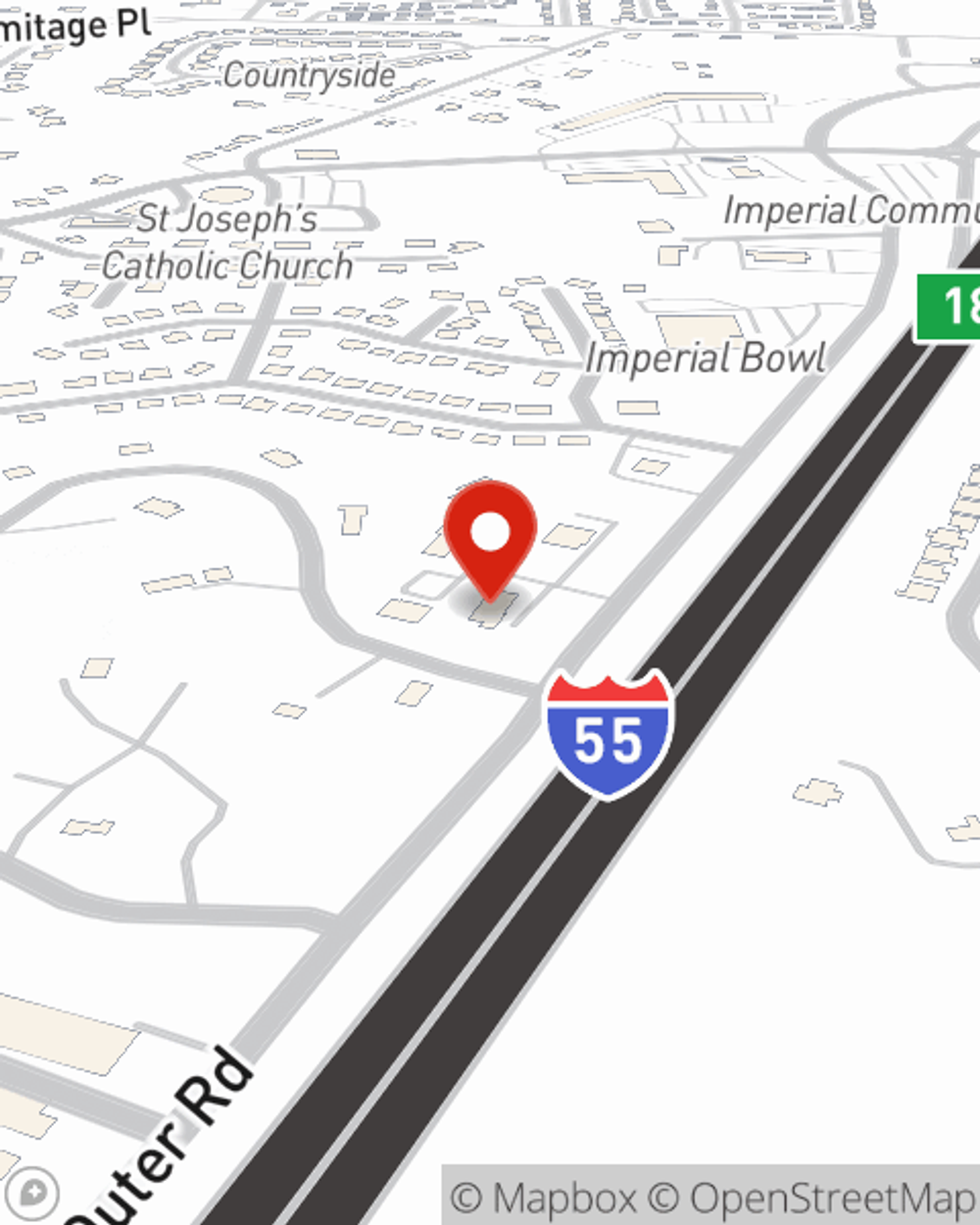

Life Insurance in and around Imperial

Protection for those you care about

Life won't wait. Neither should you.

Would you like to create a personalized life quote?

It's Never Too Soon For Life Insurance

One of the greatest ways you can protect the people you're closest to is by taking the steps to be prepared. As uncomfortable as considering this may make you feel, it's a good idea to make sure you have life insurance to prepare for the unexpected.

Protection for those you care about

Life won't wait. Neither should you.

Why Imperial Chooses State Farm

Choosing the right life insurance coverage is made easier when you work with State Farm Agent Scott Brase. Scott Brase is the sensitive associate you need to consider all your life insurance needs. So if you pass, the beneficiary you designate in your policy will help your partner or your loved ones with important living expenses such as ongoing expenses, phone bills and car payments. And you can rest easy knowing that Scott Brase can help you submit your claim so the death benefit is issued quickly and properly.

With reliable, compassionate service, State Farm agent Scott Brase can help you make sure you and your loved ones have coverage if something bad does happen. Visit Scott Brase's office now to get started on the options that are right for you.

Have More Questions About Life Insurance?

Call Scott at (636) 223-2000 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Scott Brase

State Farm® Insurance AgentSimple Insights®

Term life insurance vs. Whole life insurance: Which is right for you?

Term life insurance vs. Whole life insurance: Which is right for you?

Understanding the basics, benefits and realities of both term life insurance and whole life insurance is important in deciding which is right for you.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.